- Corruption is a major problem in the world. Every year, a global bribe of $ 1 trillion is given. It is estimated that the amount of corruption in the world is $ 2.6 trillion. So, PEPs or Politically Exposed Persons have to be seen as high risk by financial institutions due to their potential to get involved in bribery and corruption.

- Welcome to CM1 Free PEP and Sanction search! On this page you can search for Politically Exposed Persons and Sanctioned Persons and organisations. Disclaimer: Please note that the lists used for this website is data collected from free open sources and may not be up to date.

- While most financial institutions subscribe to a Political Exposed Person (PEP) list, there are many cases where these lists lack coverage or additional research is required. Below is a list of seven free additional open sources to help you track down PEP information. CIA World Leaders List.

Politically exposed persons (PEPs) are high risk clients according to the international anti-money laundering standards. Search online for PEPs, their close associates and affiliated entities.

A politically exposed person (PEP) is someone who's been appointed by a community institution, an international body or a state, including the UK, to a high-profile position within the last 12 months.

Under anti-money laundering regulations, the main aim of applying additional scrutiny to work involving PEPs is to mitigate the risk that the proceeds of bribery and corruption may be laundered, or assets otherwise stripped from their country of origin.

Identifying a PEP

PEPs can be:

- heads of state, heads of government, ministers, and deputy or assistant ministers

- members of Parliament

- members of courts of auditors or of the boards of central banks

- ambassadors, chargés d’affaires and high-ranking officers in the armed forces

- members of the administrative, management or supervisory bodies of state-owned enterprises

- members of supreme courts, constitutional courts or other high-level judicial bodies whose decisions are not generally subject to further appeal, except in exceptional circumstances

PEPs also include:

- the person’s family members

- close business associates

- beneficial owners of the person’s property (someone who enjoys the benefits of ownership even though the title of the property is in another person's name)

You should take a risk-based and proportionate approach to identifying whether you have a PEP as a client.

Situations which might suggest you have a PEP client include:

- receiving funds in the retainer from a government account

- receiving communications on official letterhead from the client or a related person

- general conversation with the client or person related to the retainer which links the person to a PEP

- news reports suggesting your client is a PEP or is linked to one

The Financial Conduct Authority (FCA) expects firms to use information that’s reasonably available to them to help identify PEPs, including:

- public domain information, such as parliament and government websites

- reliable public registers, such as the Companies House ‘register of companies’ and ‘people with significant control register’

- commercial databases that contain lists of PEPs, family members and known close associates

Ofac Pep List

You do not have to actively investigate whether beneficial owners of a client are PEPs. However, if you know that a beneficial owner is a PEP, you should consider what extra measures, if any, you need to take when dealing with that client.

E-verification providers and internet sources can often provide information about individuals and:

- their source of wealth outside of the political position

- their remuneration for their current role

They can also show whether there are any credible allegations of, or investigations into, criminal activity which you should consider when assessing risk.

Handling PEP clients

If your client is a PEP, you should apply enhanced due diligence measures. You should also treat business with PEPs on a case-by-case basis.

Under regulation 35 of the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, (MLR 2017) if your client is a PEP you must:

- get senior management approval for the business relationship

- take adequate measures to establish the source of wealth and source of funds

- closely monitor the business relationship throughout

It’s also recommended that you tell those responsible for monitoring risk assessments in your firm that a business relationship with a PEP has begun.

Once you establish that you have a PEP client, you can look at the basis on which they're categorised (lower or higher risk) and the nature of the retainer they’re asking you to undertake. This will help you make sure that your enhanced due diligence is proportionate and effective.

Lower risk PEPs

Asking basic questions and documenting the responses may adequately mitigate the increased risk of money laundering if:

- there's no question of unusual funding

- the transaction is regularly carried out by non-PEPs

Higher risk PEPs

You may need to ask further questions and gather more documentary evidence if the:

- jurisdiction which appointed the PEP is higher risk

- funding for the transaction is substantial or from an unusual source

- type of transaction is higher risk

Regulation 33(6) of the MLR 2017 indicates some transactions which may be high risk, especially where a PEP is involved.

Higher risk PEPs may still pose some risk after they leave office. Because of this, you may choose to do enhanced due diligence for longer.

A risk-based approach only relates to how many questions you ask. You should ask as many as you need to be comfortable that the retainer is consistent with the legitimate funds available to the PEP and that you do not suspect money laundering.

Reporting suspicious activity

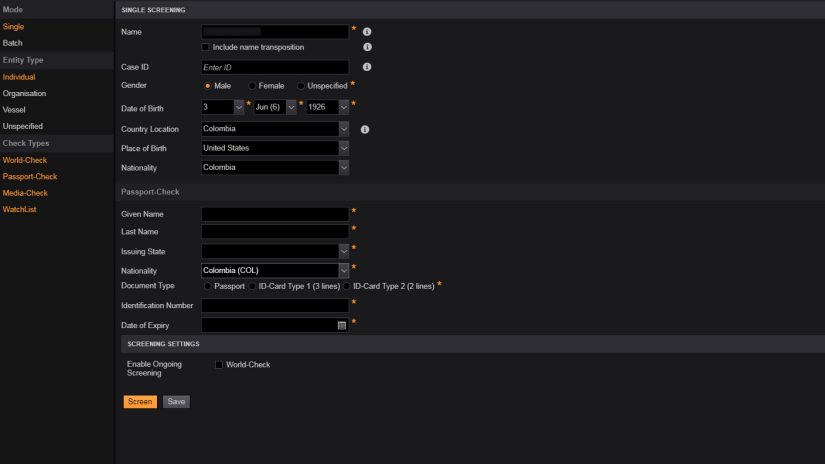

Politically Exposed Persons Check

If you know or suspect a money laundering offence is taking place, you must make a disclosure to your firm’s money laundering reporting officer (MLRO).

If you’re the MLRO and you know or suspect a money laundering offence is taking place, you must submit a suspicious activity report (SAR) to the National Crime Agency.

Resources

The Legal Sector Affinity Group’s Anti-money laundering guidance for the legal sector – Treasury-approved official guidance

Pep List Search

FCA guidance on The treatment of politically exposed persons for anti-money laundering purposes